TAX UPDATES AS OF MAY 2023

- OPTIONAL MONTHLY VAT (2550M) FILING (ALLOWED!!!)

While the Tax Code now mandates the filing of VAT returns and payment of the corresponding VAT liabilities on a quarterly basis, the BIR issued Revenue Memorandum Circular (RMC) No. 52-2023 (dated May 10, 2023), to clarify that VAT-registered taxpayers may continue to file and pay the VAT on a monthly basis and still use the BIR form No. 2550M.

All significant guidelines and procedures in using the BIR form No. 2550M shall continue to apply.

If the VAT-registered taxpayer opts to switch from filing the VAT return and paying tax on a monthly basis using BIR form No. 2550M to quarterly filing using BIR form No. 2550Q, or vice versa, no penalties shall arise.

- MONTHLY VAT (2550M) FILING NO LONGER REQUIRED

VAT-registered taxpayers are no longer required to file the Monthly Value-Added Tax Declaration, effective January 1, 2023. This is in accordance in the Revenue Memorandum Circular (RMC) No. 5-2023 issued by the Bureau of Internal Revenue (BIR), dated January 13, 2023, providing transitory provisions for the implementation of quarterly filing of VAT returns pursuant to the provisions of Republic Act (RA) No. 10963, otherwise known as TRAIN Law.

This means that VAT-registered taxpayers are only required to file Quarterly VAT Returns (BIR Form 2550Q) within 25 days from the close of each taxable quarter.

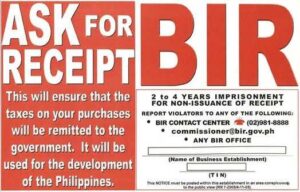

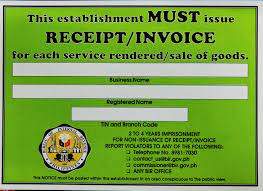

- BIR TO REPLACE “ASK FOR RECEIPT” NOTICE

All existing “Ask for Receipt” notices will remain valid until June 30, 2023. With the new Revenue Memorandum Order No. 43-2022 dated September 29, 2022, the new Notice to Issue Receipt or Invoice also called NIRI BIR is now green.

OLD

NEW

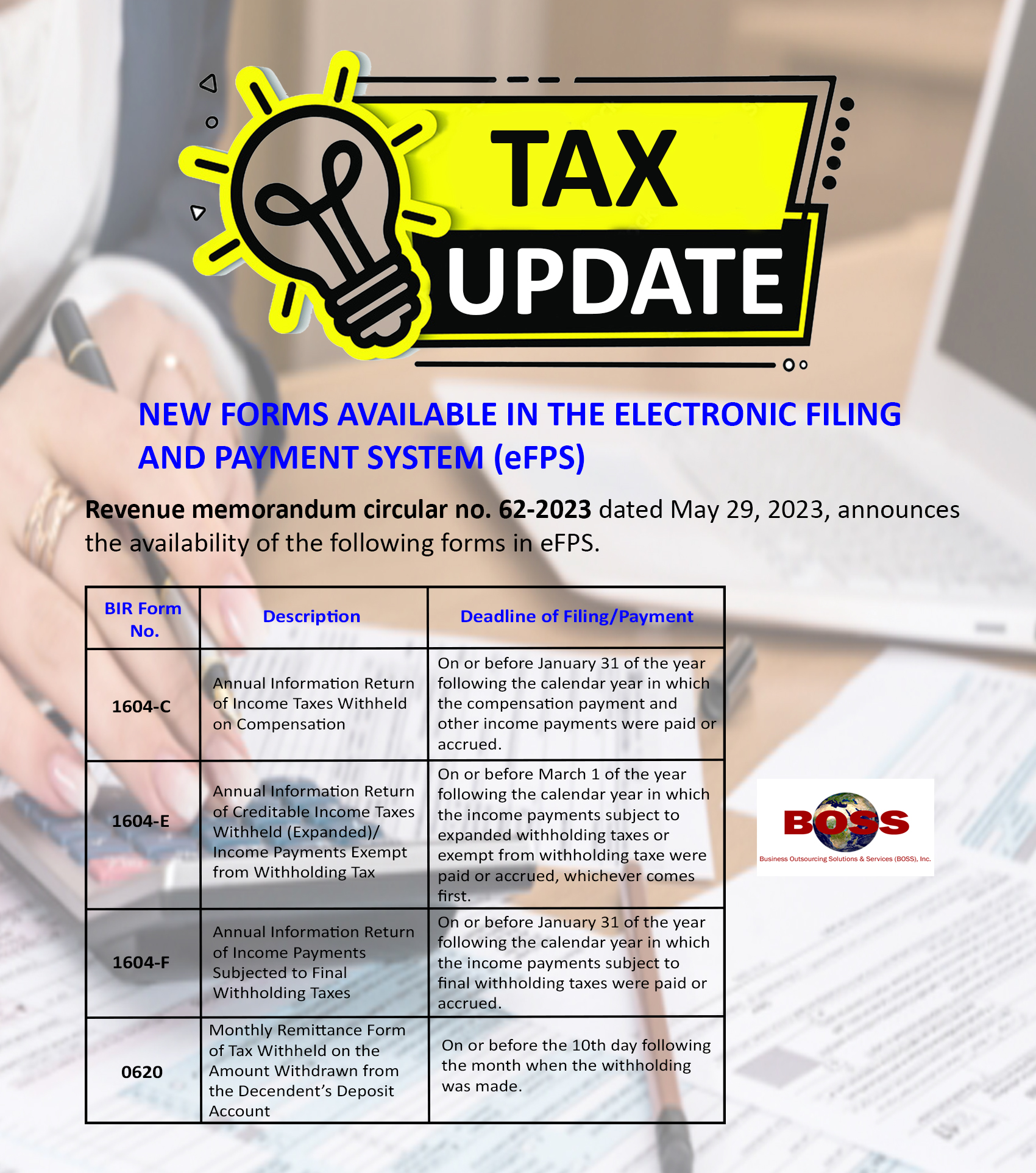

- NEW FORMS AVAILABLE IN THE ELECTRONIC FILING AND PAYMENT SYSTEM (eFPS)

Revenue memorandum circular no. 62-2023 dated May 29, 2023, announces the availability of the following forms in eFPS.

BIR form no.: 1604-C

Description: Annual Information Return of Income Taxes Withheld on Compensation

Deadline of Filing/Payment: On or before January 31 of the year following the calendar year in which the compensation payment and other income payments were paid or accrued.

BIR form no.: 1604-E

Description: Annual Information Return of Creditable Income Taxes Withheld (Expanded)/Income Payments Exempt from Withholding Tax

Deadline of Filing/Payment: On or before March 1 of the year following the calendar year in which the income payments subject to expanded withholding taxes or exempt from withholding tax were paid or accrued, whichever comes first.

BIR form no.: 1604-F

Description: Annual Information Return of Income Payments Subjected to Final Withholding Taxes

Deadline of Filing/Payment: On or before January 31 of the year following the calendar year in which the income payments subject to final withholding taxes were paid or accrued.

BIR form no.: 0620

Description: Monthly Remittance Form of Tax Withheld on the Amount Withdrawn from the Decedent’s Deposit Account

Deadline of Filing/Payment: On or before the 10th day following the month when the withholding was made.