SEC Update as of March 3, 2025:

The Securities and Exchange Commission (SEC) has recently released SEC Memorandum Circular (MC) No. 1, s. 2025, outlining the rules for the 2025 filing of Annual Financial Statements (AFS) and the General Information Sheet (GIS). Key points include:

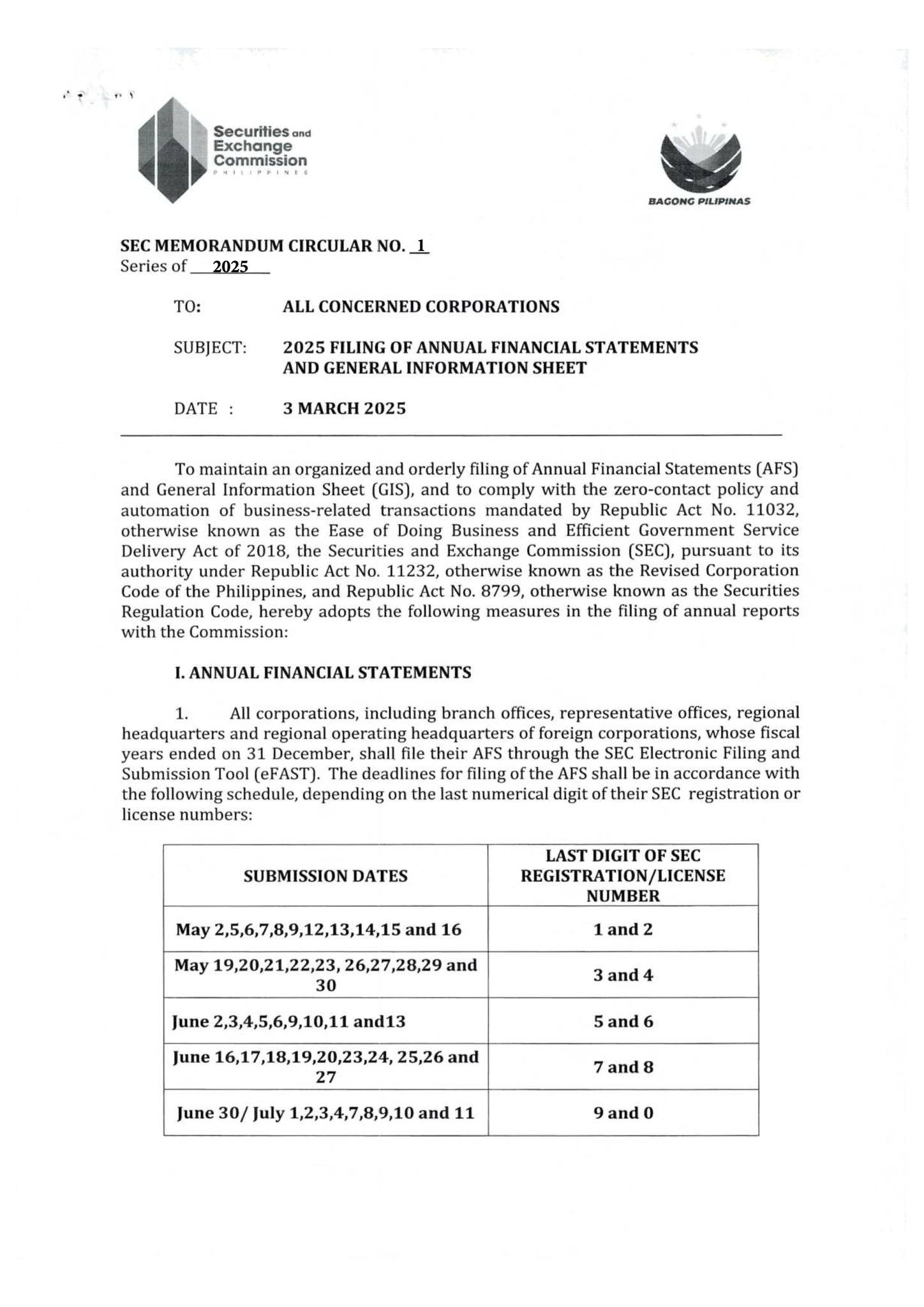

‣ All corporations, including branch offices, representative offices, regional headquarters, and regional operating headquarters of foreign corporations, whose fiscal year ends on December 31, must file via the SEC’s eFAST system according to the schedule specified in this MC, based on the last numerical digit of their SEC registration or license number.

‣ For corporations with a fiscal year ending on a date other than December 31, the AFS must be submitted within 120 calendar days after the close of their respective fiscal years.

‣ Corporations can submit their AFS before the start of the assigned coding schedule, regardless of the last digit of their SEC registration or license number.

‣ Late filings or submissions after July 11, 2025, will incur penalties.

‣ AFS submissions, except for consolidated financial statements, must be stamped “received” by the Bureau of Internal Revenue (BIR) or its Authorized Agent Banks (AABs). For submissions via BIR’s eAFS, the system-generated Transaction Reference Number or Confirmation Receipt should be included in place of the manual stamp.

‣ GIS must be submitted within 30 calendar days from the date of the annual shareholders’/members’ meeting (for domestic stock/non-stock corporations) or the anniversary of the issuance of the SEC license (for foreign corporations).

‣ For One Person Corporations (OPCs), the appointment of officers must be submitted within 15 days from the issuance of the OPC’s Certificate of Incorporation or within 5 days from when the date appears (per SEC MC No. 7, s. 2019).

Source: SEC website